A perfectly competitive market is a market that has many small firms and many individual buyers. Each seller has a very small share of the market, and as a result is a price taker; they cannot control the market price. Also, the products are all identical, and the consumers have perfect information about the market. That is, as soon as one firm prices its goods higher than its competitors, consumers will know and will switch to buying from other firms.

Additionally, there no barriers for entering or exiting the market, thus new competitors can arise at any moment, and companies can easily leave the market if they are losing profit.

Individual firm in the short run...

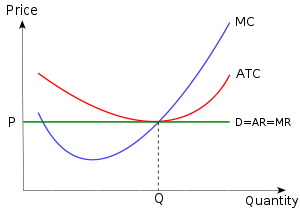

As mentioned above, each individual firm has such a small share of the market that it doesn't affect the market price at all. This means that whatever quantity it produces, it can always sell all of them at the market price, and the marginal revenue is constant. As marginal revenue is constant, the average revenue is also constant. So P=MR=AR.

A firm will always produce at a point where MR=MC. And since P=MR=AR, it will produce at a level where MC=P=MR=AR.

However, at this point, the price may be at, above, or below the average cost curve of the firm. If price is equal to average cost, then the company is making normal profit:

|

| There is neither economic profit nor loss |

If price is above the average cost, then the firm will be making economic profit:

|

| Yellow area= economic profit |

If price is below average cost, then the firm loses economic profit:

To shut down or not?

If a firm is currently operating at a loss, it has to decide whether to temporarily shut down or not. Either way, it will have to pay the fixed costs. However, by shutting down temporarily, it can avoid paying the variable costs (since it's not producing anything).

So if the price is lower than the average variable cost, then it should shut down: the revenue received is lower than the (extra) cost to produce the units, so the firm is better off not selling anything.

On the other hand, if the price is higher than the average variable cost, then the firm shouldn't shutdown. The revenue is enough to cover the variable costs, so the firm can minimize its losses by continuing to operate.

In the long run...

Earlier, I mentioned how in the short run, a firm may be making economic profit, breaking even, or operating at a loss. However, on the long run, firms tend to all break even. This is because that if the existing firms are earning economic profits, new firms will join the market due the its profitability. This causes prices to go down, and the firms lose their economic profits. On the other hand, any company that's losing profit in the long run will want to drop out of the market, and only the companies that are breaking even will remain.

So this is the graph for the long run:

Efficiency of Perfect Competition:

Allocative Efficient: perfectly competitive markets are allocatively efficient because no company is making economic profit; P=MC.

Productively efficient: perfectly competitive markets are also productively efficient, because MC=AC, which means that AC is at its lowest point.